Tunisia Late Penalties | New Rates & Protection Strategies

Tax & Legal

Nov 30, 2025

While much attention focused on visible tax measures, a silent revolution occurred in the 2023 finance law: the near-systematic doubling of late penalties. Unlike previous years, no tax amnesty measures were included. The message is clear: the Tunisian state wants to be paid on time.

The Game-Changing New Rates (2026 applicable)

Before 2023, late penalties seemed manageable. Today, they're potentially fatal for fragile cash flows:

Delay with voluntary regularization: 1.25% (vs. 0.75% before)

Delay detected by tax audit: 2.25% (vs. 1.25% before)

New fixed fine: 10% of amounts due

VAT and tax fraud: 20% of amounts due

Real-World Example: Actual Impact on Your Cash Flow

Take a business with 100,000 DT in taxes due:

2019 Scenario (old rates)

Voluntary delay: 750 DT

Detected delay: 1,250 DT

2023-2026 Scenario (new rates)

Voluntary delay: 1,250 DT (+67%)

Detected delay: 2,250 DT (+80%)

Plus 10% fixed fine: additional 10,000 DT

The Good News: An Escape Clause Exists

The law provides for a possible reduction if payment occurs within 30 days with debt acknowledgment: the 2.25% rate drops to 1.5%. This narrow but crucial window can save your business thousands of dinars in penalties.

Beyond Declarations: Other Little-Known Offenses

Many businesses are unaware of other violations that can strike at any time:

Failure to clear purchase orders: 2,000 to 5,000 DT per order

Irregular VAT-suspended sales: 50% of tax amounts

Undocumented transfer pricing: 0.5% of transactions (minimum 50,000 DT)

Excessive cash payments: 20% of amount (minimum 1,000 DT)

How to Check Your Status in 2 Minutes

The Ministry of Finance has established a simple SMS service:

Tax status: Send "SF YOUR_TAX_ID" to 85580

Traffic fines: Send "RD YOUR_ID" to 85580

Automatic alerts: Send "AD YOUR_TAX_ID" to 85580

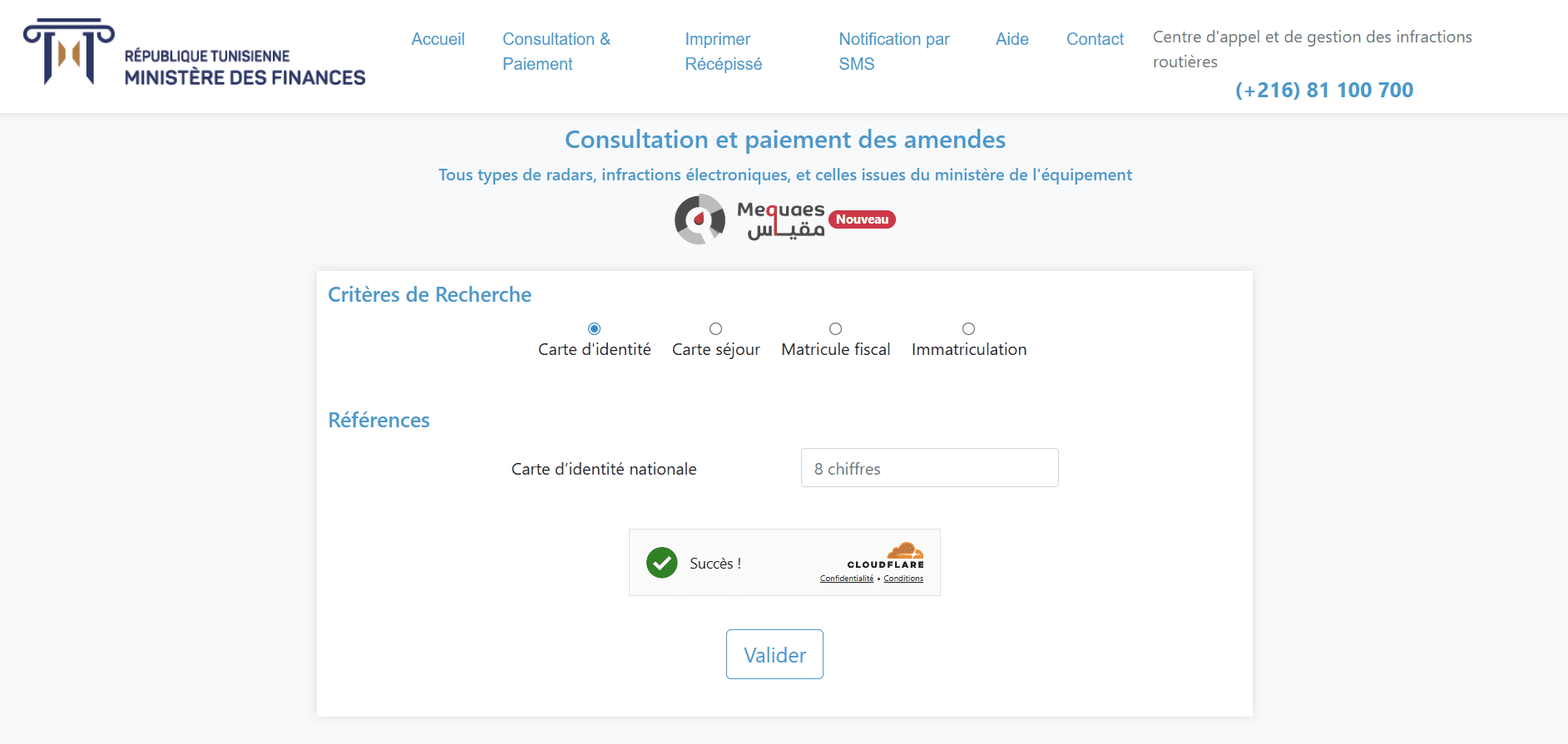

The Tele-Amende Service: Your Unknown Ally

The website amendes.finances.gov.tn allows you to:

Check all your violations in real-time

Prepare fine payments (soon online)

Understand appeal procedures

Access complete legal framework

Protection Strategy: 4 Immediate Actions

Preventive audit: Have your declaration processes verified now

Automated calendar: Never miss another deadline

Continuous training: Your team must know the new rules

Monthly SMS verification: Use the 85580 service every month

Client Testimonial: The Business That Saved 45,000 DT

"We used to treat tax filings as a secondary priority. In January 2023, our new accountant alerted us to the new rates. We conducted a complete audit and discovered 3 late declarations that we immediately regularized. Estimated savings: 45,000 DT in avoided penalties."

The Zero-Tolerance Era Has Arrived

The new penalties transform tax management from a simple administrative obligation into a strategic imperative. In this new context, ignorance is expensive and procrastination becomes a luxury few businesses can afford.

FAQ:

Do the new penalties apply retroactively?

No, only to declarations due from January 1, 2023.

How to contest a penalty?

Through a contentious claim, but success is uncertain. Better to prevent.

Are very small businesses affected?

Absolutely. The new rates apply to all businesses, regardless of size.

Protection Process:

Vulnerability diagnosis

Implementation of automatic alerts

Team training

Quarterly compliance audit

The Legal Foundation: Code des Droits et Procédures Fiscaux

The entire penalty ecosystem is built upon the legal bedrock of the Code des Droits et Procédures Fiscaux (CDPF). This document is not a mere list of rules; it is an algorithmic blueprint. Key articles, particularly those governing majorations (surcharges) and intérêts de retard (late payment interest), function as the source code for penalty calculation. Understanding this code allows an investor to model fiscal risk with a high degree of accuracy.

The Penalty Calculation Algorithm: A Mathematical Model

The Tunisian penalty system operates on a predictable, though often punitive, mathematical model. The base formula for a standard late payment penalty can be expressed as:

P = (D * r * t) + (D)

Where:

P = Total Penalty

D = Due Tax Amount

r = monthly delay rate

t = Time delay in days

This formula demonstrates that penalties are not flat fees but are exponential in nature, scaling directly with the tax due and the time elapsed. For large corporate tax liabilities, even a short delay can result in a significant financial impact, directly eroding ROI.

Know more about our services : Tax Audit Support Tunisia – Professional & Compliant - Luca Pacioli