Tax Amnesty in Tunisia 2026: Conditions, Benefits, and Detailed Payment Schedule

Tax & Legal

Dec 30, 2025

Pursuant to Article 69 of the 2026 Finance Law, Tunisian authorities have established an exceptional tax amnesty measure. This framework offers a broad and structured regularization opportunity for taxpayers in non-compliant situations. Here is a detailed analysis of its main provisions.

1. Scope of the Amnesty

The amnesty aims to regularize three distinct situations:

Tax debts already recorded by the administration.

Administrative tax offenses.

Unfiled or underreported tax declarations.

2. Detailed Measures and Conditions

A. For Recorded Tax Debts

Benefit granted: Full waiver of control penalties, recovery penalties, and prosecution fees.

Eligible debts:

Those recorded in the tax collectors' accounts before January 1, 2026.

Those recorded after January 1, 2026 but resulting from a tax audit whose outcomes (conciliation or default assessment) were notified before June 20, 2026, and concerning declarations due before October 31, 2025.

Those made enforceable by a final judgment concerning the tax base and recorded before June 20, 2026.

Conditions to be met:

Subscription to a payment schedule no later than June 30, 2026.

Full payment of the first installment according to this schedule.

Settlement of the balance in quarterly installments over a period not exceeding 5 years.

Important exclusion: Debts that already benefit from a payment schedule under previous regularization procedures.

B. For Administrative Tax Offenses

Benefit granted: Waiver of 50% of the remaining amount of penalties and associated prosecution fees.

Eligible penalties:

Those recorded in the tax collectors' accounts before June 20, 2026.

Conditions to be met (choice of one):

Payment of the due amount in a single lump sum.

OR subscription to a payment schedule and payment of the entire first installment no later than June 30, 2026.

Exclusion: Again, debts already integrated into a prior payment schedule are excluded.

C. For Unfiled or Corrective Declarations

Benefit granted: Waiver of penalties under Articles 81, 82, and 85 of the Tax Code (related to failure or delay in filing).

Declarations concerned:

Declarations (including deeds subject to registration duties) whose deadline was before October 31, 2025, provided they are not time-barred.

They must be filed between January 1, 2026, and September 30, 2026.

Condition to be met:

Payment of the principal tax due upon filing the declaration or completing the registration formality.

Broad scope:

This measure applies both to initially omitted declarations and to corrective declarations, even if filed after the initiation of a tax audit or after the notification of its results.

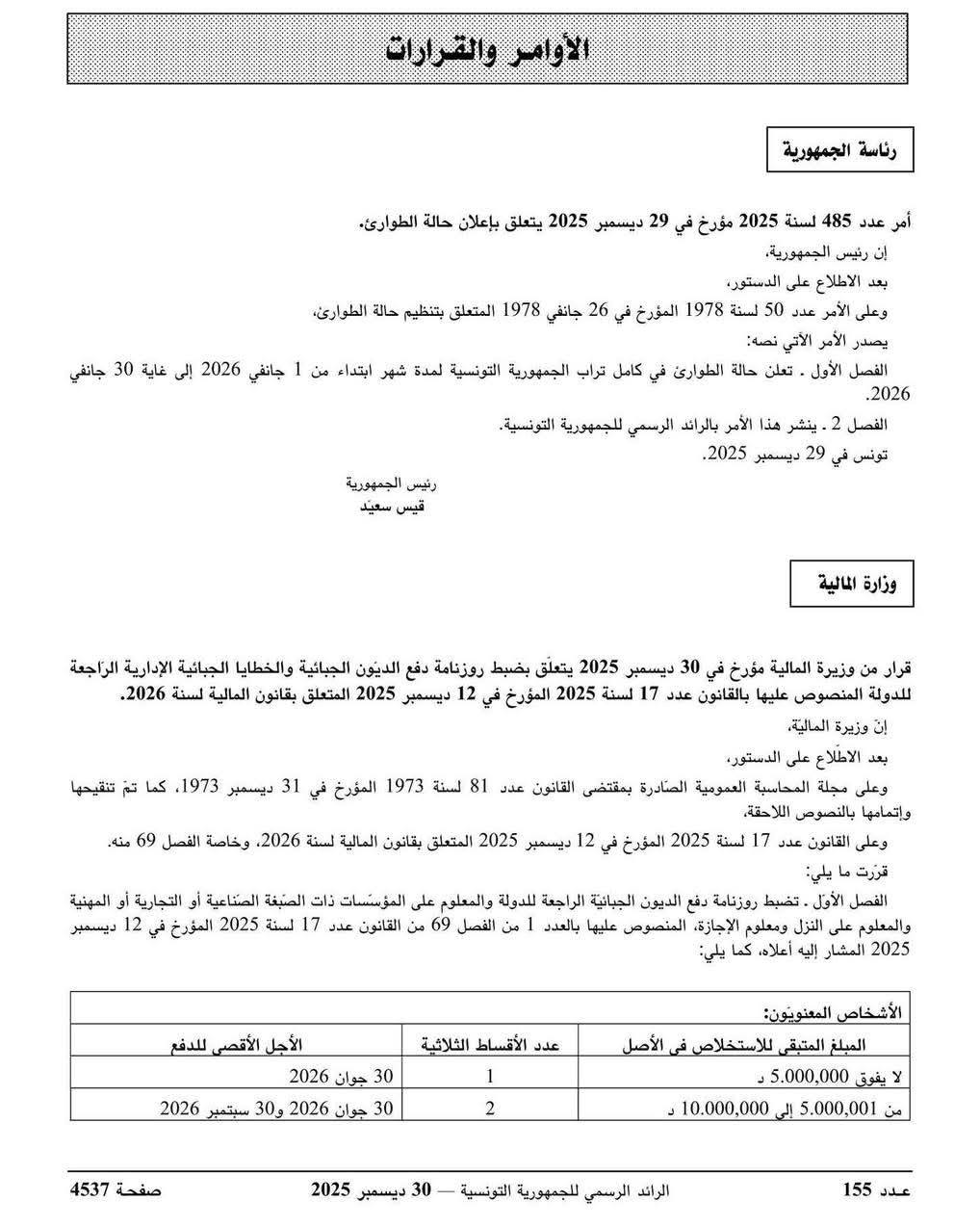

3. Payment Schedule and Deadlines of the tax amnesty 2026

According to implementing texts, the payment of the remaining principal can be spread over several quarterly installments, the number of which varies based on the amount and the taxpayer's status (individual or legal entity).

4. Strategic Recommendations

Urgent diagnostic: Assess your situation regarding the three aspects (debts, offenses, missing declarations).

Anticipate deadlines: The date June 30, 2026 is crucial for subscribing to payment schedules and paying the first installments. The date September 30, 2026 is the limit for filing omitted declarations.

Weigh the options: Study the best approach between a long-term payment plan and the accelerated payment option (with a 50% penalty waiver for offenses).

Consult us: The complexity of the conditions and financial stakes justify consultation with a tax advisor to secure your approach.

The 2026 tax amnesty is a structured, time-limited framework with substantial benefits. It allows for settling past tax liabilities with full or partial exemption from financial penalties, under the strict condition of committing to pay the principal and adhering to administrative deadlines. Prompt and methodical action is key to fully benefiting from it.