Tunisia Wealth Tax 2026: Inclusion of Movable Assets, 1% Rate, Complete Step-by-Step Guide (Finance Law 2026 Art. 88)

Tax & Legal

Dec 17, 2025

Wealth tax Finance law 2026 Reform

The 2026 Finance Law introduces a major overhaul of Tunisia’s wealth tax, expanding its base to include movable assets and increasing the tax rates. This measure aims to enhance fiscal fairness and broaden state resources.

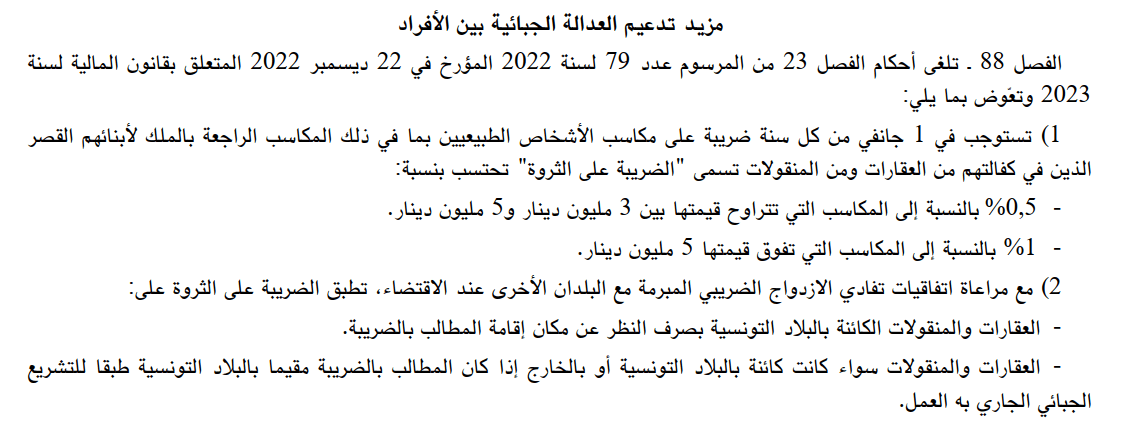

Law as Written (Art. 88)

Article 88 of the 2026 Finance Law states:

“A tax titled ‘wealth tax’ shall be levied each January 1 on the assets of every natural person […] including real estate and movable assets, calculated as follows:

- 0.5% for assets valued between 3 and 5 million dinars.

- 1% for assets valued above 5 million dinars.”

Key Takeaways - Wealth Tax 2026

Major change: Inclusion of movable assets (cars, boats, securities, etc.).

Higher rate: Increased to 1% above 5 million dinars.

Tax date: Levied on January 1 each year.

Broader scope: Assets of minor children under guardianship are included.

Declaration: Mandatory before end of June, with electronic filing available.

Detailed Scope of the new wealth Tax

1. Who is Liable?

All natural persons residing in Tunisia (under tax law).

Non-residents owning assets in Tunisia.

Assets of minor children under guardianship are aggregated with the guardian’s.

2. Taxable Assets

a) Real Estate

Developed and undeveloped land.

Ownership, bare ownership, usufruct.

Leased properties, regardless of use.

Properties acquired, inherited, or received as gifts.

b) Tangible Movable Assets

Vehicles (cars, motorcycles, pleasure boats, etc.) — subject to conditions.

Artwork, jewelry, valuable objects.

Equipment and materials not used for professional activity.

c) Intangible Movable Assets

Financial securities: shares, bonds, partnership interests, mutual funds, deposit certificates.

Life insurance contracts.

Receivables (partner current accounts, etc.).

Treasury bills, commercial paper.

d) Business Assets

Included unless actively used in a professional activity.

3. Exempt Assets

Primary residence of the taxpayer, including related furniture.

Assets used for professional activity (real estate, movable assets, business assets).

Non-utility vehicles with fiscal horsepower ≤ 12 CV.

Bank deposits (banks, financial institutions, Tunisian Post).

Agricultural land if agricultural income is declared (per Joint Note No. 15/2023).

Professional assets held within an individual enterprise (inventory, business assets).

Shares in a company conducting the same activity are, however, taxable.

Calculation Rates

Asset Value Range | Tax Rate |

|---|---|

≤ 3,000,000 DT | Exempt |

3,000,001 – 5,000,000 DT | 0.5% |

> 5,000,000 DT | 1% |

Tax Base: Value of assets after deducting debts secured by taxable assets (mortgages, loans against securities, etc.).

Deductible debts are those recognized under the Real Rights Code, excluding real guarantees in favor of companies.

International Treaties & Double taxation

Tunisia has double taxation treaties with the following countries that include provisions on wealth:

Europe Continent : Germany, Denmark, Norway, Sweden, Austria, Spain, Romania, Czech Republic, Belgium, Luxembourg, Serbia, Turkey.

America Continent : Canada.

Principle: A Tunisian resident owning assets in one of these countries may claim a tax credit to avoid double taxation.

Practical Examples

Example 1: Assets worth 4.8 million DT

Composition: Primary residence (exempt) + rental apartment (2.5M DT) + securities portfolio (2.3M DT).

Taxable assets: 2.5 + 2.3 = 4.8 M DT.

Tax due: 4,800,000 × 0.5% = 24,000 DT.

Example 2: Assets worth 6.2 million DT

Composition: Secondary villa (3M DT) + luxury car (0.2M DT) + company shares (3M DT).

Taxable assets: 6.2 M DT.

Tax due: 6,200,000 × 1% = 62,000 DT.

Declaration Process

Deadlines

Due date: June 30 of each year.

First declaration for 2026: by June 30, 2026.

Methods

Declaration on official form provided by the tax authority.

Electronic filing available via the tax administration’s secure platforms.

Payment due upon declaration.

Place of Declaration

For residents: location of primary tax domicile.

For non-residents: location of the highest-value asset in Tunisia.

Audit & Penalties of Wealth tax 2026

Tax Audit

Authorities may verify declaration accuracy.

Checks may include:

Valuation of declared assets.

Compliance with exemption conditions (e.g., actual use of primary residence).

Consistency between declared wealth and reported income.

Penalties

Failure to declare:

Delay with voluntary regularization: 1.25% (per month, or fraction of month)

Delay detected by tax audit: 2.25% (per month, or fraction of month)

New fixed fine: 10% of amounts due

Planning & Recommendations

Assess your assets as of January 1 with a qualified accountant.

Document exemptions (proof of primary residence, professional use certificates).

Consider consolidating movable assets within a family holding if relevant.

Review international treaty implications for foreign-held assets.

Ensure liquidity for tax payment.

The 2026 wealth tax marks a significant shift in Tunisian taxation, with a broader base and increased rates. Accurate declaration and proactive wealth planning are essential to optimize your tax position. Consulting a tax advisor is highly recommended in case of uncertainty.

Sources: 2026 Finance Law (Art. 88), Tax Procedures Code, Joint Note No. 15/2023, international tax treaties.

Next Steps

Contact us for a study

Receive personalized advisory plan

Begin preparation of your next steps

WeChat ID: lucapaciolitunisia

WeChat Number: +21629310433

Here is a link to our direct WhatsApp: https://wa.link/u60tk9

Read more :